For public companies and their investor relations teams, social media can be an easy way to interact with shareholders, many of whom are on Facebook, Twitter, LinkedIn and other networks. A 2016 Greenwich Association report found that nearly 80 percent of institutional investors regularly use social media, with most saying that posts and tweets had influenced their investing decisions.

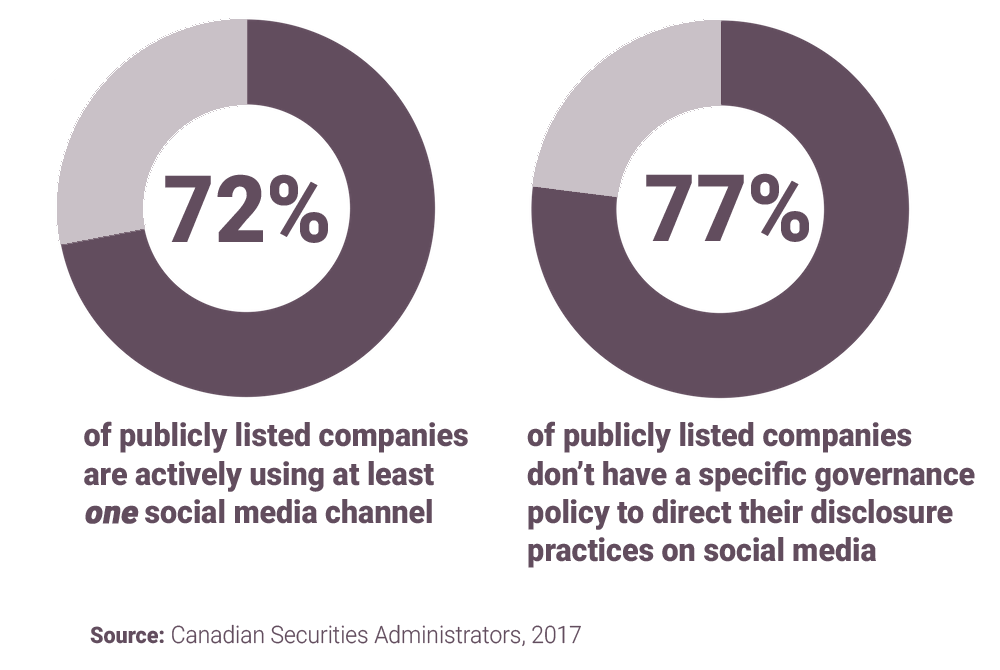

Despite those figures, many issuers do not have comprehensive social media governance policies, and many investor relations officers (IROs) are unconvinced regarding the value of these online communication platforms. A Canadian Securities Administrators (CSA) report, released in March, found that while 72 percent of publicly listed companies are actively using at least one social media channel, 77 percent do not have a specific governance policy to direct their disclosure practices on these sites. (click to tweet![]() )

)

However, with social media use only increasing, and investors finding more company information online than ever, IROs are continually working toward learning how best to incorporate social networking into their jobs. It’s not as easy as it may seem, with shareholders, regulators and business media all paying close attention to what public companies post and tweet. This white paper explores the myriad issues IROs must be mindful of when using social media, and offers suggestions on how to properly use these sites.

Dealing with disclosures

One of the main concerns for security administrators across the country, and a worry for IROs, is improper disclosure over social media. In March, the CSA issued guidance around social media use, saying that companies must report key information via a news release before reporting it on social networks. The reason is that news releases are filed on SEDAR, where every investor can see the same information at the same time. It’s worth noting that the U.S. Securities and Exchange Commission has taken a different approach, allowing companies to report information via social sites first, as long as it tells investors which network will be used.

The CSA also issued a host of rules around disclosure expectations, such as ensuring statements are truthful, that announcements of material changes are factual and balanced, that unfavourable news gets disclosed as quickly as favourable news, and more. The point is to make sure that posts or tweets don’t impact a company’s stock price in any meaningful way, especially since shareholders may see a post at different times, if they see it at all.

Before the CSA issued its guidance, it reviewed the social media disclosure of 111 reporting issuers to see if they were complying with National Policy 51-201: Disclosure Standards, and National Instrument 51-102: Continuous Disclosure Obligations. The review raised some serious concerns, said Louis Morisset, CSA chair and president and CEO of the Autorité des marchés financiers, in a March news release.

“Our review revealed concerns about how issuers are using social media websites, including specific instances where deficient social media disclosure may have resulted in material stock price movements and investor harm,” he said. “We expect issuers to adhere to high-quality disclosure practices, regardless of the venue of disclosure, and encourage issuers to implement a strong social media governance policy.”

In Canada, disclosing information that is material to a company’s operations over improper channels violates securities rules. Although Canada has a fragmented regulatory system of 13 provincial and territorial securities regulators, all make it clear that access to material information must be provided fairly to shareholders.

In general, disclosure is a challenge for publicly listed companies. Businesses are legally required to provide a massive amount of information and data to shareholders, and the dissemination of that information can be difficult, says David Scott, principal of DS Consulting, a Toronto-based communications consulting firm. The current regulatory framework essentially encourages unwieldy data dumps, or as Scott calls it, “the kitchen-sink approach.”

That makes it difficult for companies to use a platform like Twitter, where each post is limited to 140 characters. Legal departments worry that information contained in a tweet could be seen as being disclosed improperly and could then draw the ire of regulators. It doesn’t help that the regulators’ current guidelines on social media are too paternalistic, says Scott.

The CSA, for instance, recommends against using social media to disclose any material information at all. “The CSA has to evaluate the effectiveness of current channels,” says Scott. “It’s one thing to say everything is available on SEDAR, but I’d like to see how many people go on SEDAR. I don’t know anyone, outside of the industry and journalists, who even know what SEDAR is.”

Creating a framework

In any case, rules must be followed, which makes it even more important to develop a solid framework around social media use. While many companies do have social media guidelines these days, it’s important that IROs either create their own documents or get themselves included in the broader policies that are usually developed by the marketing department. (click to tweet![]() )

)

A policy should outline what can and can’t be posted – and include the CSA’s social media guidelines so that whoever is posting knows the regulator’s rules – what sites to post on, when and where it’s appropriate to use social media, who’s responsible for posting and anything else that may come up around social media use.

When Megan Hjulfors, supervisor of communications and investor relations at ARC Resources Ltd., got her company onto Facebook and Twitter in 2011, procedures were put into place that dictated the type of content to post and how to interact with users.

“The first thing I did when I started was look at, operationally, the procedures we had in place for social media,” she says. “Who was the approver? Who had access? What were our posting guidelines?”

When it comes to posting itself, think about what should and shouldn’t be posted on one’s social channels. While the CSA recommends against material disclosures, companies can follow up on the disclosures that appear on their website and on SEDAR with more succinct breakdowns on social media. (click to tweet![]() )

)

This is how ARC Resources uses its accounts, especially when it comes to YouTube, which it uses regularly.

“We release 115 pages long of disclosure, but for the average investor, this is so much information to cover and absorb,” says Hjulfors. “Success for us is to boil the ocean and distill what the key messages are in three minutes.”

Using social media to move away from the traditional data dumps is a positive step, says Scott. “I applaud companies that do that. They’re not just meeting the legal requirement of dumping all the information,” he says. Scott points to the mounds of metrics that can be collected from social media – such as engagement per post, who’s opening emails, how long someone watches a video – as incredibly powerful tools that can help improve communication. “Let’s start using that data,” he says.

If information can’t fit into 140-character snippets or a Facebook post, then consider using social media to drive traffic to the company’s website, where news releases and more in-depth disclosures can be found, says Erin O’Toole, senior stakeholder relations specialist for NovaGold Resources Inc. “A goal for us is to encourage the volume of positive discussions of our company and always direct it back to our website,” she says.

Effective social media use goes beyond just posting on the Internet, adds O’Toole. It’s also important to engage in “social listening” – monitoring the types of conversations that clients, stakeholders and others are having about their company on various social networks. If IROs understand what’s being discussed online, they can then use social media to specifically target problems, such as misinformation being spread about a company.

For instance, NovaGold uses Twitter to fix incorrect news stories that could have a material impact on its stock. In September 2016, the company’s Twitter account tweeted to the Financial Post’s account about a detail the news outlet got wrong in a story. The article had incorrectly stated that NovaGold had been upgraded from underweight to neutral, when in fact it had been upgraded from neutral to overweight, says O’Toole. The post was subsequently fixed.

Developing best practices

There are plenty of Canadian companies that are doing social media well, but when it comes to developing frameworks and policies, Scott suggests looking south of the border, where the SEC has created a more in-depth set of guidelines for American companies using social media. “It boils down to ‘don’t surprise people,’” says Scott. That’s the first rule companies should follow: Let people know when you’re going to be posting information. “Make sure you have that strong information awareness,” he says. (click to tweet![]() )

)

Another best practice is to actively manage and engage when negative news is swirling ar ound a company. Too many companies go radio-silent on social in a crisis, or resort to brief statements drafted by legal departments, says Scott. “Being brave enough to talk about negative issues on social media should be seen as a good thing,” he says. “Talking about negatives could be a great tool for crisis management and shareholder engagement.” (click to tweet

ound a company. Too many companies go radio-silent on social in a crisis, or resort to brief statements drafted by legal departments, says Scott. “Being brave enough to talk about negative issues on social media should be seen as a good thing,” he says. “Talking about negatives could be a great tool for crisis management and shareholder engagement.” (click to tweet![]() )

)

Typically, when shareholders read about a crisis in a company they’re invested in, they turn to their financial advisor or sources outside the company to gain an understanding of what is happening. They’re not checking the dcompany’s social media accounts, because they think that IR isn’t going to provide timely information and context. “Investors are not going to investor relations when there’s a crisis,” Scott. “Companies need to look at how to populate social channels to say, ‘We’re on this.’”

This requires engagement, and IR teams need to be trained how to engage properly. O’Toole says that in the event there’s negative sentiment being posted on a platform like Twitter from a user, she’ll go in and engage. However, if it’s clear that the conversation risks spiralling into a long, heated exchange, she’ll tweet out her number to the user and ask them to call her.

“What I’ve learned from those long Twitter threads is that if someone is going to engage in a lot of dialogue or is looking for an answer that’s too complicated to respond to, I’ll respond with my phone number,” she says. “Half the time they call and it’s resolved, the other half they’ll back down. By engaging in that way, you’ve nipped it in the bud. That’s been quite valuable for us.”

Scott agrees that engaging rather than ignoring is the best option. “The default of ‘Let’s not say anything’ might be good legal counsel, but not necessarily good communication,” he says.

Creating good content

There’s no formula for creating compelling content on social media, especially when it comes to investor relations, but a good rule of thumb is that any message should be transparent and easily digestible. Social media users, shareholders or otherwise, are more likely to interact or share content that informs them. (click to tweet![]() )

)

At ARC, Hjulfors focuses on producing YouTube videos where executives can explain new developments at the company to shareholders, or where they can break down complicated documents such as information circulars into digestible snippets. For instance, in November, the company produced a video on YouTube that asked COO Terry Anderson to provide a breakdown of operations in the third quarter. The goal is to make the company’s material information, such as forward-looking statements and earnings releases, accessible to all investors.

While ARC only regularly started using YouTube in 2012, its videos have so far received positive feedback from shareholders and other stakeholders. “We have had analysts call and actually tell us the videos are very helpful,” she says. “When we’re travelling to another country that we’re not in that frequently, we’ll have portfolio managers we’re meeting with say they watched the videos and they’re all caught up with what’s been happening with ARC.”

Videos also allow retail investors to get access to executives they otherwise wouldn’t be able to get. “Our analysts and big investors have the opportunity to sit down with the C-suite,” she says. “Retail investors don’t get that opportunity, but they can with our videos.” (click to tweet![]() )

)

Video coverage can even make investor days, which are typically for analysts, accessible to all shareholders, says Scott. He cites videos being produced by Toronto-Dominion Bank and Bank of Nova Scotia as particularly effective. “They’re broadcasting investor days and not keeping them as just the domain of analysts,” he says. “Making that accessible is saying, ‘Let’s get this out there and make this digestible.’ It’s a great way to keep shareholders top of mind.”

In addition to video, LinkedIn is a platform that organizations should be leveraging. O’Toole says that in the beginning, NovaGold neglected the platform, preferring to focus on Twitter and Facebook – platforms where the number of users was rapidly growing. But a recent audit looking into which social media sites were the most effective found that, in terms of engagement, LinkedIn was best. “With LinkedIn, we kept our activity to posting news releases,” says O’Toole. “But our audit found that we got a ton of engagement there. It’s interesting the traction that the platform is getting for us. It shows the learning curve about what sort of content resonates.”

The company found that users who followed NovaGold on LinkedIn had a higher rate of interaction with posts, such as clicking links, than those on other platforms like Twitter and Facebook. “I do use it a lot more now and find that posts about our community-engagement initiatives work well there,” she says.

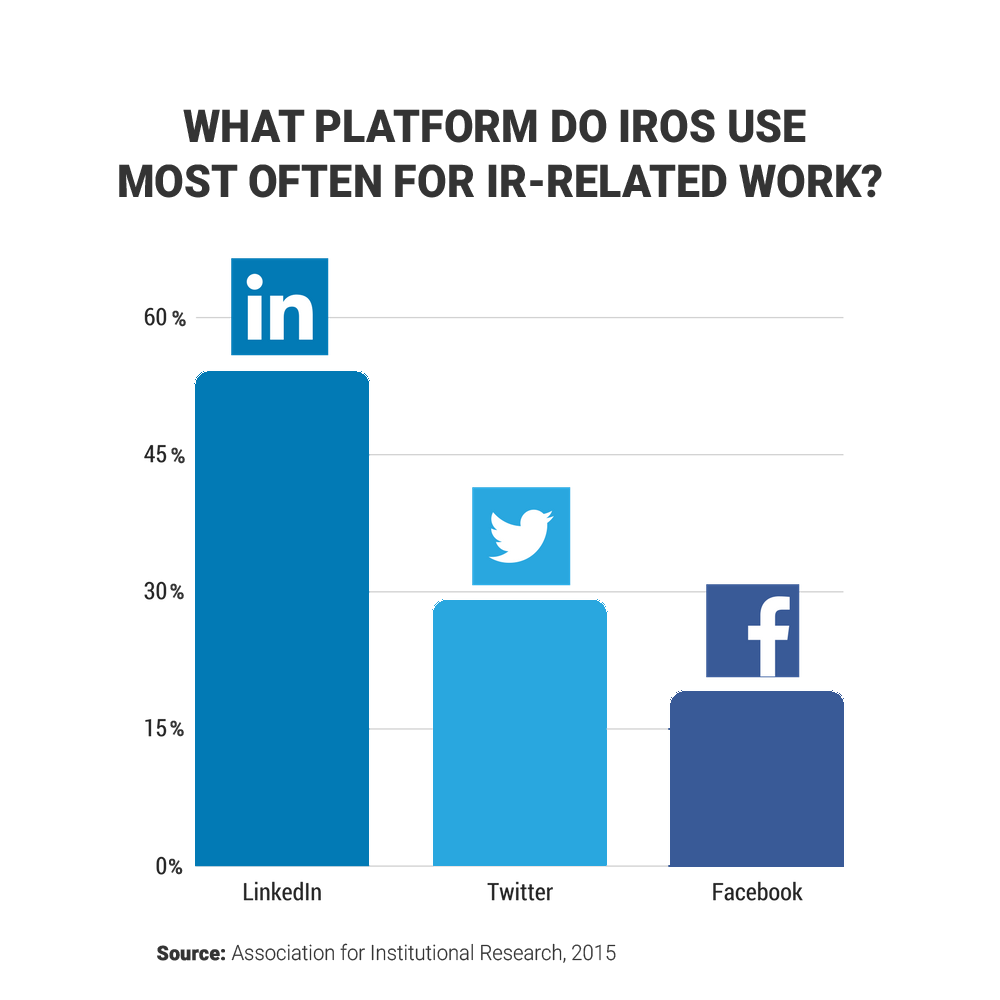

Other research backs up O’Toole’s audit. A 2014 survey found that among investment professionals, LinkedIn was the most visited site for professional information, on par with investment forums and financial services blogs. The survey found that only 22 percent of investment professionals said they consulted Twitter frequently or very frequently for professional purposes, and only 10 percent said the same of Facebook.

A June 2015 survey by the Association for Institutional Research found that more IR professionals are using LinkedIn, with 54 percent of respondents saying they use the site for IR-related work, while only 29 percent and 19 percent said they use Facebook and Twitter, respectively. (click to tweet![]() )

)

Finding the right followers and friends

One of the other challenges that IROs face is understanding what people want to see on the various networks, as each site does have a different kind of follower or friend. O’Toole finds that Twitter has a more sophisticated audience than Facebook, for instance. There are more portfolio managers, regulators and people interested in the industry interacting with public companies.

Facebook, by comparison, is used for more personal interactions. NovaGold, for instance, uses its Facebook page as way to interact with community members near its Donlin Gold project in southwest Alaska, who may have concerns about the mine’s environmental impact. (click to tweet![]() )

)

“In that area, residents use Facebook essentially as their news, so if we’re posting on Facebook about this project, we’re primarily speaking to those individuals,” she says. “There’s a lot of misinformation about how mines might impact fisheries and the environment, and it’s very important our company is involved in these discussions.”

One audience that IROs are eager to engage with on social media is retail investors. “The buy side and sell side have more tools at their disposal to get information than the average retail shareholder,” says Hjulfors. “We aim to communicate on social media in a way that is more accessible and engages with a broader audience, including retail investors.”

But both O’Toole and Hjulfors say this audience has proven more difficult to attract than analysts and institutional investors. Much of that likely has to do with the fact that when retail investors have questions, they still turn to their financial advisor or broker, adds Scott.

Evaluating social’s worth

One of the big questions company executives often have is whether the time and effort that’s required for social media, especially IRO-related posting, is worth it. Companies don’t have to use social media, of course – there’s no legal requirement to have an account – and social networking to target clients and customers is a separate marketing-department issue.

However, O’Toole says there have been a number of situations at her company where social media has demonstrated its worth. She points to a day nearly five years ago where the company’s share price saw a significant drop in value following the market’s misinterpretation of information surrounding one of its partners’ news releases. “Our Twitter was blowing up with all these assumptions, and we put out a very quick tweet recognizing the issue and saying a news release is coming out soon,” she says.

Since discussions about companies on social media can materially impact a firm – Donald Trump caused Lockheed Martin’s stock to fall by one percent after he criticized America’s F-35 fighter jet program on Twitter, for instance – having a way to immediately clarify rumours or misinformation is critical. “The whole purpose of it is to direct people,” says O’Toole. “That’s been quite valuable for us.”

From a monetary standpoint, it can be difficult to place a value on the benefits of social media, but it’s clear that there are tangible advantages to the platform, from countering negative news to highlighting positive information. (click to tweet![]() )

)

For IROs, though, social media really can break down that information dump that typically comes with company disclosures. This is especially important for companies that don’t get covered in the news. “We rely upon analysts and media to break it down, but not every stock is covered or written about,” says Scott. “For those stocks not being covered, they have to turn to these 150-page documents, which are very hard to read.”

Moving away from that will translate into more transparency, better shareholder engagement and happier investors. That’s a worthwhile return, says Scott.